The word deposit is often used in two different contexts when buying property:

- For the Bank: The amount you have in savings (or equity) to qualify for a loan.

- Under the Agreement for Sale and Purchase: The first instalment you pay to the vendor (the person selling the property), usually when the agreement goes unconditional.

For the Bank

The bank will require that you have a deposit in order to approve a loan. A standard deposit is 20% of the purchase price and anything less is often referred to as a low deposit. The bank will typically lend you the remaining balance of the purchase price. A low deposit loan application may be more involved.

This type of deposit refers to the amount of money you have already saved which you will contribute toward the purchase price. It can also be referred to as your personal contribution, as it represents the portion of the purchase price you are personally contributing, as opposed to the amount you are borrowing from the bank. This might be made up of savings, KiwiSaver, and gifts from family members.

Under the Agreement

An agreement for sale and purchase includes a deposit that is payable to the vendor. This deposit is part of the total purchase price and is usually paid when the agreement goes unconditional. The deposit demonstrates good faith that you are committed to the transaction.

There are no fixed rules about how much you must pay as a deposit under the agreement. A typical deposit is around 10% of the purchase price, but you can offer a different percentage or a set dollar amount.

You can use your KiwiSaver funds as part of your deposit, but you need to allow enough time in your finance condition for your KiwiSaver application to be processed before confirming the agreement. Most KiwiSaver providers take 10-15 working days to process withdrawal applications, so we recommend including 15 working days to confirm your finance condition if you plan to use your KiwiSaver funds to pay the deposit. You will also need to include a clause in the agreement recording that the deposit cannot be released to the vendor before settlement.

If there is a real estate agent involved, ensure you discuss this with them early in the process of making an offer and seek legal advice before signing your Agreement.

Example

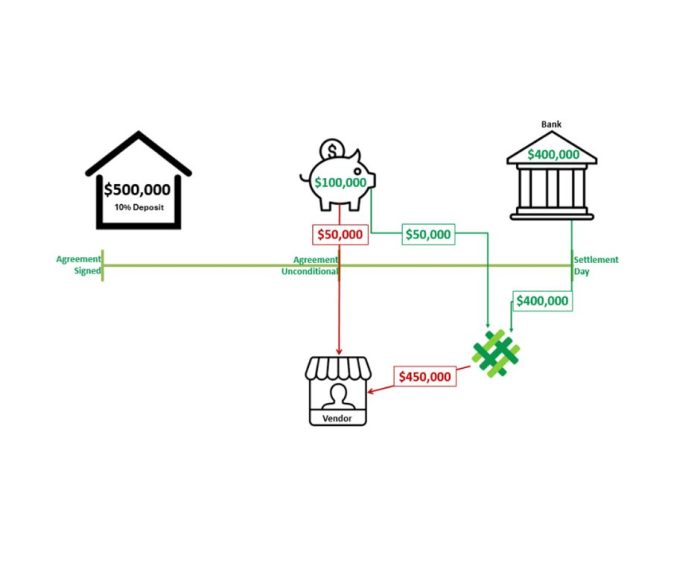

- You’ve entered into an Agreement for Sale and Purchase to buy a property for $500,000.

- The Agreement states that you will pay a 10% deposit of $50,000 to the vendor.

- The bank requires that you have a 20% deposit in order to approve a loan for the rest of the purchase price.

- You have $100,000 made up of savings and KiwiSaver funds. This meets the banks requirements, so the bank agrees to lend you $400,000.

- When the agreement goes unconditional, you pay the 10% deposit of $50,000 to the vendor via the agent or the vendor’s solicitor (depending on what is set out in the Agreement).

- The remaining $50,000 from your personal contribution will go toward settlement. You will pay this to your lawyer prior to settlement day.

- On settlement day, the bank will pay the $400,000 loan to your lawyer. Once they have received the funds from the bank, they will pay the balance of the purchase price ($450,000) to the vendor’s solicitor.